Introduction

SME Corp. Malaysia as the Secretariat to the National SME Development Council (NSDC) has been conducting surveys on SMEs since 2009 to gauge the quarterly business performance as well as to seek feedback on current issues facing SMEs in Malaysia. The surveys which were conducted in collaboration with Bank Negara Malaysia (BNM) were well represented in terms of economic sectors, geographical spread (including East Malaysia), establishment size as well as gender.

SME Outlook during 2018 • Covering 1,469 respondents, survey findings indicated that business performance of SMEs sustained in the third quarter 2017 (3Q 2017). • With a sample size of 2,236 SMEs, findings showed that SMEs had better business performance in the first quarter 2017 (1Q 2017). · Findings showed that business performance of SMEs, in terms of sales and profits, remained relatively stable in the 3Q 2016. SME Performance during 2019

Economics and Policy Division

SME Corp. Malaysia

8 April 2021

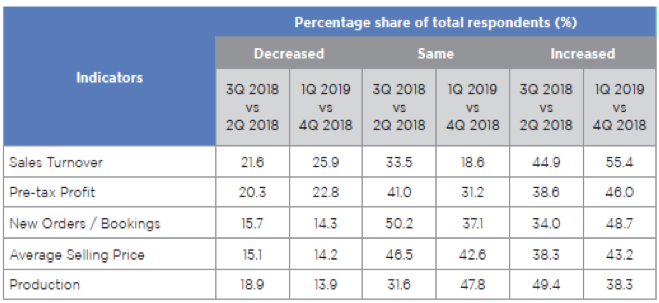

SME Performance during Third Quarter 2018

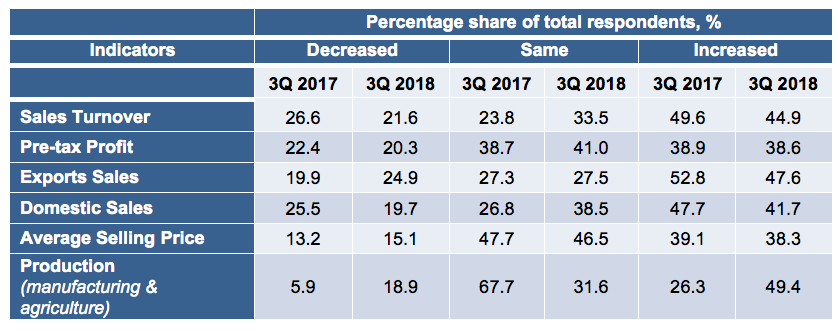

SME Performance during Third Quarter 2017

• About 50% of respondents experienced higher sales (3Q’ 16: 43.8%) while about 39% earned higher profits (3Q’16: 33.4%).

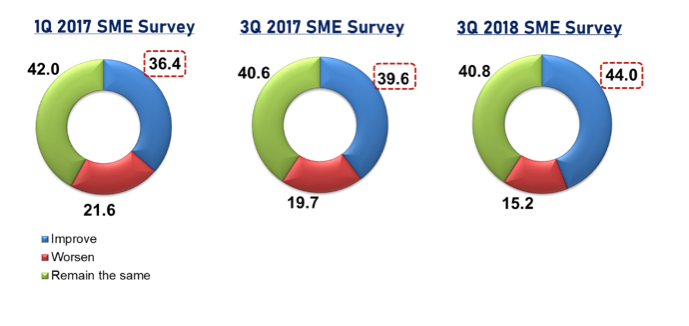

SME Outlook during Third Quarter 2017

• The gradual improvement from the past year also reflected in the near-term outlook, as about 40% of respondents were expecting their business to improve, higher than 36.4% recorded in the previous quarter, thus indicating that SMEs have become more optimistic.

• Key factors contributing to the improved business outlook were positive consumer confidence, positive business sentiment and higher consumer spending.

• Despite the upbeat outlook, there are lingering concerns on the rising cost of business and lower demand of goods and services.

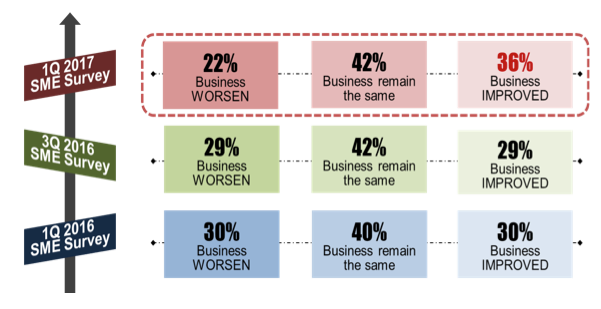

SME Performance during First Quarter 2017

• Detailed findings revealed that more respondents experienced higher sales and profits in the 1Q 2017 compared to the previous quarter. A close look at the findings showed that about 49% of the respondents experienced higher sales (3Q’16: 44%), while about 41% earned higher profits (3Q’16: 33%).

SME Outlook during First Quarter 2017

• The gradual improvement in business performance was further reflected in a better short-term outlook. About 36% of the respondents were expecting their business to improve, higher than 29.2% recorded previously, thus indicating that SMEs have become more optimistic.

• Among the key factors contributing to the improved business outlook were positive consumer confidence, positive business sentiment and higher consumer spending.

• Despite the upbeat outlook, there are lingering concerns on the rising cost of business and lower demand of goods and services.

SME Performance during Third Quarter 2016

· Detailed findings revealed that about 44% of the respondents experienced higher sales (1Q’16: 42.2%) and one-third recorded higher profits (1Q’16: 32.1%), compared with previous quarter.

· SMEs had continued concerns on the rising business costs as well as falling demand of goods & services.

Indicators

Decreased

Same Performance

Increased

Percentage share of total respondents, %

3Q 2016

1Q 2016

3Q 2016

1Q 2016

3Q 2016

1Q 2016

Sales Turnover

27.8

32.8

28.4

25.0

43.8

42.2

Pre-tax Profit

26.8

28.4

39.9

39.5

33.4

32.1

Average Selling Price

13.8

14.4

56.6

53.0

29.6

32.6

Exports Sales

18.8

16.3

52.7

50.7

28.5

33.0

Production (mfg & agri)

8.8

13.0

67.4

61.1

23.8

25.9

Domestic Sales

26.7

30.9

33.0

29.2

40.4

39.9

SME Outlook during Third Quarter 2016

· On the outlook for the next six month, most respondents are expecting their business to remain stable albeit modest performance. Meanwhile, about 29% are very optimistic on the outlook, particularly microenterprises and those in manufacturing and services sectors.

· The key factors supporting an improved business outlook were positive consumer confidence, positive business sentiment and higher consumer spending.

Source: 3Q 2016 SME Corp. Malaysia Survey

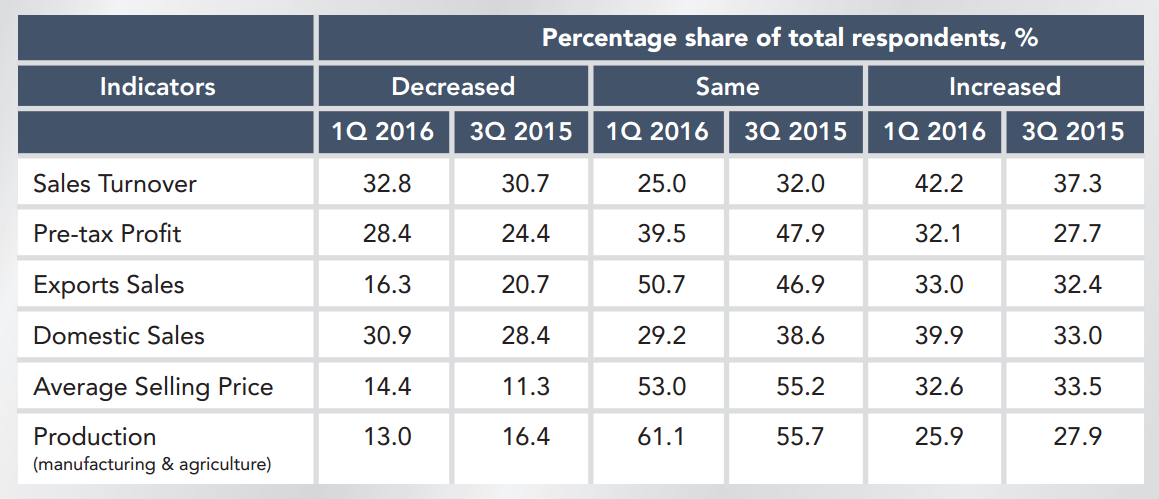

SME Performance during First Quarter 2016

SME Outlook during First Quarter 2016

The gradual improvement in business performance was further reflected in a better near-term outlook. About 30.4% of the respondents were expecting their business to improve compared to 28.3% in the previous quarter survey, while the number of respondents citing a worsening outlook reduced significantly to only 30.2% as compared to 40.5% recorded in the previous survey. The improved outlook was also reflected by the higher orders or bookings received during the quarter (1Q 2016: 27.5% vs 3Q 2015: 21.8%).SME Performance during Third Quarter 2015

Indicators

Percentage share of total respondents, %

Decreased

Same

Increased

3Q 2015

1Q 2015

3Q 2015

1Q 2015

3Q 2015

1Q 2015

Sales Turnover

30.7

25.6

32.0

35.4

37.3

39.0

Pre-tax Profit

24.4

19.8

47.9

52.9

27.7

27.3

Exports Sales

20.7

13.2

46.9

61.2

32.4

25.6

Domestic Sales

28.4

20.3

38.6

48.2

33.0

31.5

Average Selling Price

11.3

11.6

55.2

59.7

33.5

28.7

Production (manufacturing & agriculture)

16.4

8.6

55.7

65.0

27.9

26.3

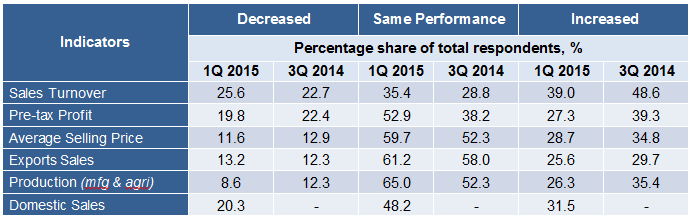

SME Performance during First Quarter 2015

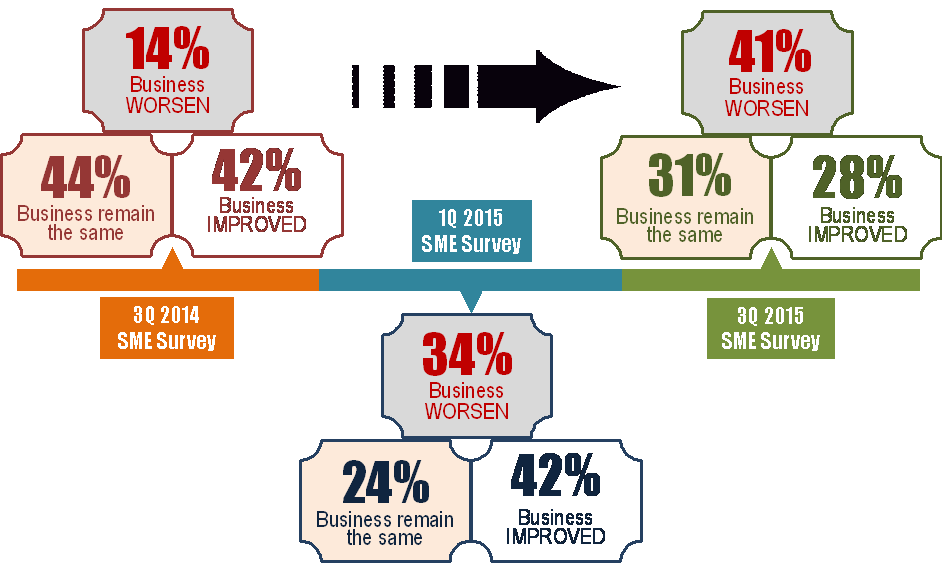

SME Outlook during First Quarter 2015

Short-term Business Outlook

• Respondents were less optimistic on the business outlook for the next 6 months

• About one-third of the respondents were expecting their business prospects to worsen, compared to only 7% about a year ago

• Respondents in the construction, services and agriculture sectors were expecting a worsening outlook and mainly among the medium and small-sized firmsSME Performance during Third Quarter 2014

SME Outlook during Third Quarter 2014

Short-term Business Outlook

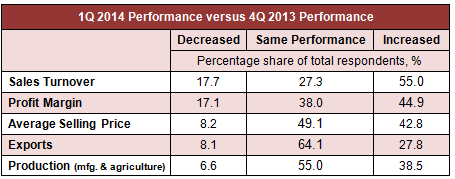

• Respondents remained relatively optimistic on the near-term outlook, as 42% of them cited improved business performance in the next 6 months until March 2015, particularly microenterprises and those in manufacturing sectorSME Performance during First Quarter 2014

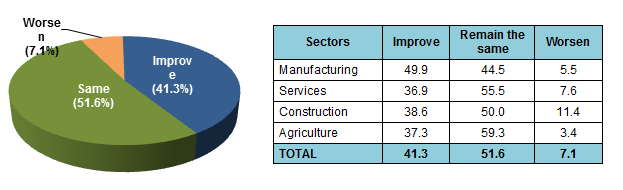

SME Outlook during First Quarter 2014

• Overall, most respondents (51.6%) foresee that their current business conditions will remain the same in the next 6 months, mainly among the small-sized SMEs and those in the agriculture sector.

• However, comparison across sectors shows that respondents in the manufacturing sector were generally optimistic as half of them cited better performance in the near-term.

For further information, kindly contact:

Puan Farah Yasmin Yahya

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel: 03 – 2775 6057