APEC has always recognise the significant role of SMEs in the growth and dynamism of the Asia-Pacific region. The APEC SME Ministerial Meeting (SMEMM) is held annually to discuss the SMEs issues in greater depth. At its first meeting in 1993, APEC Leaders identified the importance of APEC in advancing a policy dialogue on SMEs. Under the overarching theme of APEC 2020 “Optimising Human Potential towards a Resilient Future of Shared Prosperity: Pivot. Prioritise. Progress”, the 26th APEC SME Ministerial Meeting (SMEMM) was virtually hosted on 23 October 2020 where all the APEC SME Ministers convened lead by the Chairmanship of H.E. Dato Sri Dr. Haji Wan Junaidi Bin Tuanku Jaafar, Minister of Entrepreneur Development and Cooperatives, Malaysia. The SMEMM discussed matters under two main sub-themes which were:-Background of APEC

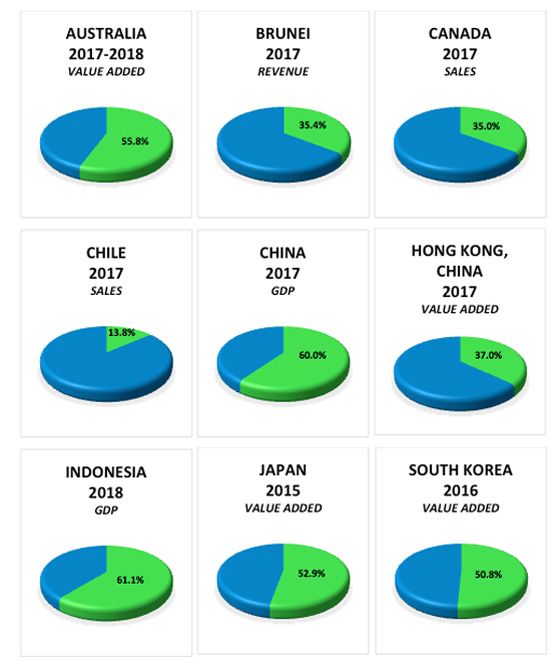

SMEs account for over 97% of all enterprises in the APEC region and employ over half of the workforce. SMEs contribute significantly to economic growth across APEC member economies with the SME share of GDP ranging from 20 - 50%.

For more information on APEC please visit the following link http://www.apec.org/APEC SME Economic Contribution

SME Corp. Malaysia’s Role in APEC

Through our involvement in Asia-Pacific Economic Cooperation (APEC), continuous efforts are made in ensuring Malaysian SMEs obtain optimum benefits via active participation in various APEC programmes and activities. APEC is active in promoting the sharing of knowledge and information by making various economic studies, benchmarking and best practices that are available online for member economies to access. This eases cross-referencing among member economies including Malaysia, to develop policies and programmes that will facilitate SMEs development in the respective countries.

In addition, Malaysia also works closely across different Working Groups (WGs) in ensuring that the APEC initiatives benefit the SMEs in Malaysia and other member economies collectively. APEC SME Working Group (SMEWG)

In line with its vision to develop progressive SMEs, the rich platform of APEC provides great opportunities for Malaysia to learn on best policies and practices, as well as creating synergy between Malaysian SMEs and the SMEs in the other APEC member economies. SME Corp. Malaysia, under the ambit of the Ministry of Entrepreneur Development and Cooperatives (MEDAC), assumes significant roles in the APEC SME Working Group (SMEWG). The APEC SMEWG meets twice a year to plan and work on initiatives that would benefit the SMEs across APEC economies.

The SMEWG has been actively assuming its role to encourage development of SMEs among the APEC member economies. The SMEWG was established in February 1995 as the Ad Hoc Policy Level Group on SMEs (PLGSME). The group was then renamed as the Small and Medium Enterprises Working Group (SMEWG) in the year 2000. The SMEWG is the champion within the APEC region for inclusive development of sustainable SMEs that are well prepared to meet the challenges of the 21st century.

The SMEWG has since been putting in endless efforts to promote the development of an enabling business environment and fostering capacity building among the SMEs. It enhances the synergy with other APEC foras, private sectors and stakeholders to promote the development and growth of SMEs by maximising the benefits of policy dialogues and sharing of best practices in the APEC region. Moreover, the SMEWG also serves as a vehicle to mainstream SME considerations into the mandates and activities of other APEC groups, including institutional lending, structural reform and telecommunications infrastructure.

For more information on the APEC SME Working Group, please visit the following link: http://apec.org/Groups/SOM-Steering-Committee-on-Economic-and-Technical-Cooperation/Working-Groups/Small-and-Medium-EnterprisesAPEC SME Ministerial Meeting (SMEMM)

In September 2020 SME Ministers endorsed the APEC SME Working Group (SMEWG) Strategic Plan for 2021–2024, which provided a roadmap to address critical issues pertaining to the growth of SMEs and microenterprises in the APEC region. The SMEWG will focus on five priority areas for its Strategic Plan 2021-2024: