SMEs in RMKe-12

"A Prosperous, Inclusive, Sustainable Malaysia"

Highlights

The Twelfth Malaysia Plan (RMKe-12) for period 2021 – 2025 was tabled by YAB Prime Minister in Dewan Rakyat on 27 September 2021. The Plan is anchored by three key themes, namely resetting the economy, strengthening security, well-being and inclusivity as well as advancing sustainability. RMKe-12 is an effort of the Government to plan and implement the sustainable national development agenda in line with the spirit of the Keluarga Malaysia, the aspirations of the Shared Prosperity Vision and the 2030 Agenda for Sustainable Development.

During the Plan period, the global economy is expected to regain momentum as it recovers from the COVID-19 pandemic. World trade is expected to grow by 5.3% per annum, mainly supported by better trade performance of emerging markets and developing economies. In tandem with the global economic recovery, the Malaysian economy is expected to grow between 4.5% and 5.5% per annum, resulting in a higher GNI per capita of RM57,882 or US$14,842 in 2025.

Key Facts & Figures

| |

RMKe-11

(2016 - 2020)

|

2020

(2021 - 2025) |

| GDP growth |

2.7% |

4.5% - 5.5% |

| Gross National Income (GNI) Per Capita (end-period) |

RM42,503 |

RM57,882 |

| Percentage of Fiscal Balance to GDP |

-6.2% in 2020 |

-3.5% to -3.0% |

| Federal Govt. Debt to GDP Ratio |

62.1% in 2020 |

- |

| Inflation (Average Annual Growth rate, %) |

1.3% |

2.7% |

| Unemployment Rate |

4.5% in 2020 |

4.0% in 2025 |

| Average Monthly Household Income (end-period) |

RM7,160 |

RM10,065 |

| Mean Monthly B0 Household Income |

RM3,512 (in 2019) |

RM4,200 in 2025 |

| Labour Productivity Growth (%) |

1.1% p.a. |

3.6% p.a. |

| Compaensation of Employees, end period (% of GDP) |

37.2% |

40.0% |

| Gini Coefficient |

0.407 in 2019 |

0.388 in 2025 |

| Female Labour Force Participation Rate |

55.3% in 2020 |

59.0% in 2025 |

| Malaysian Wellbeing Index (MWI) |

0.5% p.a. |

1.2% p.a. |

Real GDP by Kind of Economic Activity 2016 - 2025

| |

Average Annual Growth Rate (%) |

| |

RMKe-11

(2016 - 2020) |

RMKe-12

(2021 - 2025) |

| Real GDP |

2.7% |

4.5% - 5.5% |

| Services |

3.8 |

5.2 |

| Manufacturing |

3.3 |

5.7 |

| Construction |

-0.7 |

4.2 |

| Agriculture |

0.4 |

3.8 |

| Mining & Quarrying |

-2.2 |

2.6 |

Real GDP by Expenditure 2016 - 2025

| |

Average Annual Growth Rate (%) |

| |

RMKe-11

(2016 - 2020) |

RMKe-12

(2021 - 2025) |

| Real GDP |

2.7% |

4.5% - 5.5% |

| Private expenditure |

3.9 |

5.4 |

|

|

4.7 |

5.8 |

|

|

1.2 |

3.8 |

| Public Expenditure |

-0.8 |

3.4 |

|

|

3.2 |

3.7 |

|

|

-7.9 |

2.6 |

| Exports of Goods & Services |

0.2 |

5.8 |

| Imports of Goods & Services |

0.3 |

6.1 |

Note: GDP at constant 2015 prices

Source: Economic Planning Unit (EPU)

Themes of RMKe-12

| RMKe-12 sets a strategic direction to achieve the objective of a “Prosperous, Inclusive, Sustainable Malaysia”, focusing on efforts to rejuvenate economic growth, ensure the nation’s prosperity is distributed more fairly and equitably, as well as maintain environmental sustainability |

| Theme 1: Resetting the Economy |

Theme 2: Strengthening Security, Well-being and Inclusivity |

Theme 3: Advancing Sustainability |

- Focuses on restoring the growth momentum of key economic sectors

- Propelling strategic and high impact industries as well as MSMEs to realign growth in a sustainable trajectory

- Strengthening Malaysia’s position in the global supply chain

- Outlines two game changers in resetting the economy:

- Catalysing strategic and high impact industries to boost economic growth

- Transforming MSMEs as the new driver of growth

|

- Focus on strengthening security, well-being and inclusivity.

- Outlines four game changes:

- Enhancing national security and unity for nation-building

- Revitalising the healthcare system in ensuring a healthy and productive nation

- Transforming the approach in eradicating hardcore poverty

- Multiplying growth in less developed states especially Sabah and Sarawak to reduce development gap

|

- Focuses on advancing green growth as well as enhancing energy sustainability and transforming the water sector

- Two game changers will be implemented:

- Embracing the circular economy

- Accelerating adoption of the Integrated Water Resources Management (IWRM)

|

|

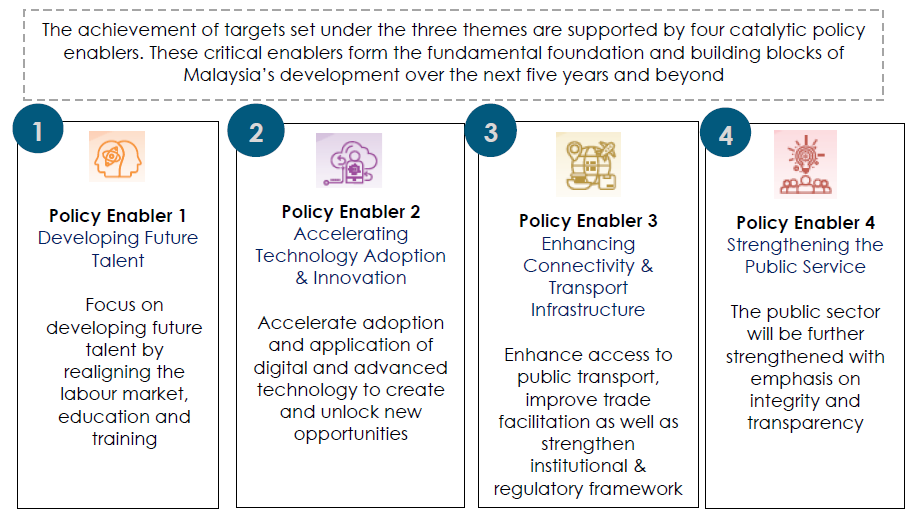

Policy Enablers of RMKe-12

SMEs in RMKe-12

Measures for MSMEs are predominately highlighted in Theme 1, Game Changer III: Transforming Micro, Small and Medium Enterprises as the New Driver of Growth

Prioritising MSME digitalisation as a national agenda is a powerful game changer for the economy. It enables MSMEs including Bumiputera entrepreneurs to transform, compete and penetrate global markets. MSMEs will be equipped with the skills to enable these enterprises to digitalise their business process by the year 2025. To enhance competitiveness, MSMEs will also be assisted to produce products and services on par with international standards. A conducive and holistic ecosystem will be created to support MSMEs. This includes giving a second chance to entrepreneurs who have tried and failed as success is very seldom achieved at the first-time attempt. A commissioner will be appointed to assist small businesses in securing payments on time and resolving payment disputes. In addition, cooperative movement will be leveraged in developing entrepreneurs.

Game Changer III

Transforming Micro, Small and Medium Enterprises as the New Driver of Growth |

| Why do we need to transform MSMEs? |

How will this be achieved? |

What will success portray? |

MSMEs are vital in promoting entrepreneurship and economic growth of the country. Transformation of MSMEs will:

- Increase the contribution of MSMEs to GDP and exports

- Enhance the competitiveness of MSMEs

- Enhance the capabilities of Bumiputera entrepreneurs

- Address the low level of technology and digital adoption

|

The transformation of MSMEs through enhancement of digital adoption and competitiveness as well as the development of a supportive ecosystem encompasses the following initiatives:

- Introducing a national MSMEs digitalisation roadmap

- Leveraging the Pusat Internet Komuniti (PIK) and Pusat Internet Desa (PID) as the one stop centres to drive digitalisation

- Developing a unified portal to facilitate entrepreneurs to obtain essential information on financing resources and advisory services

- Shifting more MSMEs from a domestic focused market to the global market

- Implementing the second chance intervention programme to assist failed entrepreneurs and mitigate the risk of bankruptcy

- Appointing a commissioner to assist small businesses in securing payments on time and resolving payment disputes

- Leveraging the cooperatives movement in developing entrepreneurs

|

- MSMEs’ contribution to GDP increases to 45%

- MSMEs’ contribution to total exports increases to 25%

- MSMEs’ average annual growth of labor productivity at 3.5%

- 90% of MSMEs digitalise their business operations

- Globally competitive MSMEs

|

|

Performance of SMEs and Targets

|

Performance in 2020

|

Targets in RMKe-12

|

Contribution of MSMEs to GDP

|

38.2%

|

45%

|

Contribution of MSMEs to Total Exports

|

13.5%

|

25%

|

Average Annual Growth of Labour Productivity of MSMEs

|

1.2%

(2016 – 2020) |

3.5%

(2021 – 2025) |

MSMEs to Digitalise Business Operations

|

N/A

|

90%

|

Bumiputera Enterprise Contribution to GDP

|

N/A

|

15%

|

Key Measures for SMEs

CHAPTER 2: Restoring Growth Momentum

|

Strategy

|

Measures

|

Strategy A2: Moving up the Value Chain

|

Improving Operational and Production Process

- Efforts will be undertaken to modernise and digitalise operations and processes in the manufacturing sector.

- Implementation of Industry 4WRD will be intensified, particularly in developing local system integrator capabilities to provide innovative solutions related to digitalisation of production processes.

Adopting Technology in New Product Development

- A more targeted approach will be taken to move the economic sectors up the value chain, producing high value, diverse and complex products through technology adoption.

- Efforts will be intensified to embrace future industries in producing high value products and enable continuous productivity improvements in the manufacturing sector. In this regard, a centre of excellence for future industries will be established to coordinate and integrate best practices and research as well as provide support and training.

|

| Strategy A3: Strengthening Financial Capability |

The financial capability of some stakeholders, particularly farmers, entrepreneurs and MSMEs will be strengthened to facilitate the adoption of emerging technology along the value chain to increase productivity. Measures will include enhancing existing incentives and introducing new financing mechanisms for technology adoption. |

| Strategy A5: Scaling Up Green Practices |

Accelerating the Adoption of Green Practices among Industries

- Industries will be encouraged to accelerate the adoption and implementation of green practices, particularly sustainable consumption and production (SCP) practices.

- The expansion of green procurement initiatives will increase demand for green products and services and catalyse the industries to shift towards green practices. Industries will be urged to procure and utilise local green products and services.

|

| Strategy B1: Improving Market Efficiency |

Initiatives to improve market efficiency will encompass connecting suppliers directly to consumers through digital platforms and enhancing supply chain sustainability. Efforts will also be undertaken to position Malaysia as a regional logistics hub, capitalising its advantage of good connectivity in the Asia-Pacific region. |

| Strategy B2: Empowering Industry to Compete in the Domestic and Global Markets |

Encouraging Collaboration among Industry: In the manufacturing sector , multinational companies (MNCs) will be incentivised to collaborate with MSMEs to strengthen backward linkages to assist MSMEs in participating in the global value chain. |

| Strategy E1: Strengthening Coordination and Collaboration |

The existing state and district offices of the Ministry of Domestic Trade and Consumer Affairs will be leveraged as a single window to facilitate MSMEs in accessing services. These include assisting in registration of business and intellectual property, application of licenses and permits as well as obtaining information related to financial assistance. |

| CHAPTER 3: Propelling Growth of Strategic and High Impact Industries as well as MSMEs |

| Strategy |

Measures |

Strategy A1: Boosting Electrical and Electronics Industry in Moving up the Value Chain

|

The implementation of the Lighthouse Project will be intensified to encourage MNCs to assist local MSMEs in embracing digitalisation and Globalisation 4.0 in their business models. In addition, the establishment of the Fourth Industrial Revolution (4IR) business platform will provide opportunities to E&E companies and MSMEs to accelerate 4IR technology adoption and innovation. |

Strategy A3: Establishing a Sustainable Aerospace Industry

|

The Aerospace industry will be transformed to produce more complex products and services. The initiatives will include developing a sustainable ecosystem, clustering and zoning of aerospace activities, establishing an aerospace digital system and venturing into sustainable energy.

|

| Strategy A4: Maximising the Potential of the Creative Industry |

Measures to accelerate the creative industry growth include developing a holistic ecosystem, upskilling talent to match industry needs as well as strengthening product development and promotion. |

| Strategy A5: Re-energising the Tourism Industry |

Measures to accelerate the creative industry growth include developing a holistic ecosystem, upskilling talent to match industry needs as well as strengthening product development and promotion. |

| Strategy A6: Fostering Competitiveness of Inclusive Halal Industry |

The role of MSMEs will be enhanced to be a key driver for the development of the halal industry. High performing MSMEs will be groomed as home-grown halal local champions. This will involve upscaling production capacity and product quality as well as promoting local brands to be on par with global brands in improving access to the international market.

|

| Strategy A7: Intensifying Smart Farming Activities |

Smart farming approach will be implemented across all subsectors in the agriculture sector. This will be undertaken by developing a comprehensive smart farming framework, accelerating the adoption of modern technologies, improving the dissemination of technological information and talent development, enhancing the participation of technology providers, and empowering local communities. |

| Strategy B1: Creating Innovative and Sustainable Entrepreneurs |

Enhancing Entrepreneurship Development Programmes

- Entrepreneurial development programmes will be further enhanced to inculcate the right mindset among aspiring entrepreneurs

- Incubation spaces will be established in rural and less developed areas to support aspiring entrepreneurs

- Outreach programmes will be intensified in boosting entrepreneurial capability and skills among youth, Bumiputera and specific groups

- Intrapreneurship development within organisations will be augmented

Promoting Innovation-Driven Entrepreneurs

- Increase the number of innovative entrepreneurs, including youth, Bumiputera and specific target groups in strategic and high impact industries

- Entrepreneurs to continuously innovate by adopting advanced and digital technology including to intensify collaboration between entrepreneurs and researchers.

|

| Strategy B2: Promoting Inclusive Participation through MSMEs, Cooperatives and Agriculture-Based Associations |

The participation of MSMEs, cooperatives and agriculture-based associations in the economy will be strengthened to ensure inclusive growth.

Increasing MSMEs Contribution to the Economy

- Initiatives to accelerate the creation of high growth and innovative firms will include enhancement of targeted assistance for automation, digitalisation, AI and other 4IR technologies

- Focus will be given to strengthening the ecosystem for future industry start-ups by creating technology and digital entrepreneurial cluster

- Targeted assistance and access to financing will be improved for the development and adoption of new technology

- Training and development programmes related to automation, digitalisation and 4IR technologies will be strengthened

- A national MSMEs digitalisation roadmap will be introduced to drive the adoption of digitalisation

- The Vendor Development Programme (VDP) will be expanded in creating more competent Bumiputera vendors among MSMEs.

Increasing Market Access and International Trade Opportunities

- Measures to enhance market access and opportunities will be further expanded

- Government Procurement will be fully leveraged to support MSMEs

- Linkages with large firms, especially MNCs will be strengthened in enabling MSMEs to have access to a bigger market; MNCs are encouraged to use locally produced materials by MSMEs

- Business-to-business (B2B) opportunities will be expanded through initiatives that encourage large companies to source locally from MSMEs - The ‘Buy Malaysia Campaign’ will be intensified

- Efforts will also be undertaken to leverage the benefits of FTAs in widening market access and accelerating the internationalisation of MSMEs.

Capitalising Cooperatives, Agriculture-based Associations and Social Enterprises in Developing Entrepreneurs

- The cooperative movement among the B40 and rural communities will be further promoted

- Blueprint Perusahaan Sosial 2021-2025 will be introduced to further strengthen social enterprise development

- Program Perolehan Impak Sosial Kerajaan (PPISK) will be rolled out to enable the onboarding of social enterprises to the national e-procurement system

|

| Strategy B3: Creating a Conducive and Holistic Ecosystem for Entrepreneurship |

Enhancing Governance, Regulations and Institutional Roles

- A corporate governance toolkit for MSMEs will be developed to improve business efficiency and performance

- Relevant laws and regulations will be improved to ensure businesses and cooperatives remain vibrant

- Measures will continue to be undertaken to encourage registration of businesses in the informal sector

- A commissioner will be appointed to provide support for small businesses in securing payments on time and will act as a mediator

- A centralised database will be established to provide comprehensive information on entrepreneurship activities; MyAssist MSME, Pusat Internet Komuniti (PIK) and Pusat Internet Desa (PID) will be further strengthened

- Roles and functions of entrepreneurship development organisations (EDOs) will be strengthened and streamlined.

Improving Access to Financing

- Co-funding initiatives between the public and private sectors will be intensified (high-potential and innovative entrepreneurs / enterprises venturing into high value-added products and services)

- Role of the Development Financial Institutions (DFIs) will be revitalised

- Access to financing for new entrepreneurs, especially start-ups, will also be improved

- Financing procedures and processes will be simplified to expedite the approval and disbursement

- Intervention programmes will be introduced to assist failed entrepreneurs and mitigate the risk of bankruptcy.

|

| CHAPTER 4:Enhancing Defence, Security, Wellbeing and Unity |

| Strategy |

Measures |

Strategy D3: Developing Sports Industry

|

Efforts will be undertaken to encourage local entrepreneurs to venture into sports goods manufacturing and marketing industry as well as sports event management and sports facility management. These entrepreneurs will be supported by creating a conducive environment, including providing access to financing, for the businesses to grow and increase competitiveness. The local sports businesses, particularly SMEs will be encouraged to participate in various local and international trade exhibitions and sports events to showcase their products and services.

|

CHAPTER 5: Addressing Poverty and Building an Inclusive Society

|

Strategy

|

Measures

|

Strategy D4: Increasing the Resilience and Sustainability of Bumiputera Businesses

|

Enhancing Capacity and Capability of Entrepreneurs

- Capacity and capability of Bumiputera entrepreneurs will be enhanced by inculcating self-reliance, a competitive mindset and a high-performance culture

- Financial and non-financial assistances will be provided based on merit and needs

- Structured coaching and mentoring programmes will be strengthened through the involvement of successful entrepreneurs in sharing business ethics and best practices

- More Bumiputera entrepreneurs will be encouraged to venture into the digital economy

Intensifying Entrepreneurship Programmes

- Start-up entrepreneurship programmes including for youth & professionals will be intensified to enhance Bumiputera participation via training and advisory services in innovative and knowledge-based businesses

- Bumiputera participation in high potential industries e.g. halal, aerospace, creative industries will be facilitated through the acquisition of local and foreign technologies as well as intellectual properties (IP)

- Corporate sector will be encouraged to create Bumiputera crowdfunding aimed at providing alternative financing to Bumiputera entrepreneurs

Enhancing Bumiputera MSMEs Participation in the Strategic High Impact and Emerging Economic Sectors

- Involvement of Bumiputera MSMEs in the Vendor Development Programme will be further intensified by including anchors among MNCs to assist new Bumiputera vendors in increasing their participation along the supply chain in emerging industries such as bio-medical devices and aerospace

- Carve-out and compete initiative will be extended to various sectors in increasing effective Bumiputera participation in the economy

- Bumiputera MSMEs will be encouraged to form consortiums and cooperatives in enhancing their capacity and capability

- VentureTECH will be injecting capital into Bumiputera companies with potential

- Clear exit policy will be formulated to encourage successful Bumiputera MSMEs to be more independent and resilient

Exploring and Expanding Businesses

- SOEs will enhance collaboration with MNCs and global companies in identifying and assisting potential Bumiputera MSMEs.

- Smart partnerships between SOEs, R&D institutions and Bumiputera MSMEs will be intensified to develop and commercialise IPs as well as innovative products and services to penetrate new markets.

- Bumiputera businesses will be promoted in new growth areas across the country, while Development Financial Institutions (DFIs) will be urged to expand financial assistance, coaching and mentoring to support potential Bumiputera entrepreneurs venturing into high value-added activities.

|

| Strategy D5: Increasing Bumiputera Wealth Creation |

Introducing New Financing Mechanisms for Non-Financial Assets

- Better terms of financing for the purchase of properties will be introduced through collaboration between FIs, private developers and investors.

- Entrepreneur development organisations (EDOs) will be encouraged to acquire and develop commercial and industrial assets under the Rent-to-Own scheme for Bumiputera entrepreneurs.

|

| Strategy D7: Ensuring Sustainable Corporate Equity Ownership |

Promoting Investment Literacy

- Bumiputera institutions, such as PNB, MARA and EKUINAS will collaborate with the Securities Commission and Bursa Malaysia in promoting investment literacy.

- Outreach programmes for initial public offering (IPO) opportunities will be intensified in encouraging individuals, companies and eligible Bumiputera cooperatives to apply for the Special Provision of Bumiputera Shares.

Enhancing the Role of SOEs as Enablers for Bumiputera Equity Ownership

- Disposal of assets owned by the GLCs and GLICs in the non-strategic sectors will be coordinated in ensuring priority will be given to qualified Bumiputera entrepreneurs and entities

- Programmes to facilitate more Bumiputera companies to be listed will be expanded through improvements to the existing programmes

- Strategic collaboration with foreign investors and fund managers will be facilitated to raise funds for Bumiputera MSMEs and public listed companies (PLCs) to become global players

- PNB will facilitate to increase the participation of Bumiputera community in digital-based financial planning and investment services

- Bumiputera companies in high value-added, green and emerging industries will be developed through the VentureTECH performance-based investment programme

|

| Strategy E2: Accelerating Socioeconomic Development of Orang Asli |

Increasing Income of Orang Asli

- Potential crops that have commercial value and traditional handicrafts will be further developed to fully exploit their potential.

- Microfinancing facilities and skills training will be provided for Orang Asli to become entrepreneurs, particularly in ecotourism, agrotourism as well as arts and handicrafts.

- State governments will be encouraged to enhance the gazettement of land for economic activities.

|

| Strategy F5: Accelerating Empowering Persons with Disabilities |

Ensuring Inclusiveness of Persons with Disabilities (PWDs)-

- Inclusiveness of PWDs in education and training, employment, financing as well as sports will be enhanced.

- More economic opportunities will be made available for PWDs through various platforms, including the sharing and digital economies.

|

CHAPTER 6: Improving Regional Balance and Inclusion

|

Strategy

|

Measures

|

Strategy A1: Accelerating Development Based on Key Growth Nodes and Hotspot Areas

|

Accelerating High Value-Added Activities

- MSMEs in the key growth nodes and hotspot areas, will be encouraged to move up the value chain and participate in high value-added activities.

- Efforts will be undertaken to facilitate industries to embrace the 4IR through the adoption of technology, automation and innovation, particularly in complex industrial processes.

Implementing Green Growth Initiatives

- Industries will also be encouraged to implement green growth initiatives by adopting green technology and best practices.

|

| Strategy A2: Attracting Quality Investment |

Intensifying Research, Development, Commercialisation and Innovation

- Efforts to enhance R&D&C&I will be intensified to increase productivity, particularly among MSMEs

- Industries will be encouraged to collaborate with HEIs and research centres to embark on research that focuses on the specific needs of the industries and communities in each region

- Anchor companies will be identified to assist MSMEs in the less developed regions

- In the agribusiness industry, anchor companies will take up an active role in providing technical assistance and greater market access to small scale agropreneurs to provide wider growth opportunities to MSMEs

|

| Strategy A3: Improving the Business Ecosystem |

Intensifying Talent and Entrepreneurship Development

- Efforts will be undertaken to intensify talent development and reduce skills mismatch to meet industry demand as well as enhance entrepreneurship development in every region.

- Talent development programmes will continuously be revised, emphasising 4IR knowledge and skills to keep pace with the dynamic requirements of industry.

- Tailored training concerning the identified key economic activities in each region will be undertaken through collaboration with respective HEIs and TVET institutions.

- Industries will be encouraged to provide internship programmes.

- Entrepreneurship programmes will also be enhanced to spur new businesses and produce more job creators at the regional level.

Enhancing Collaboration in the Production Networks

- MSMEs will be encouraged to increase participation in the broader production networks encompassing large firms and MNCs to move up the value chain, open up new business opportunities, increase market access and facilitate the adoption of 4IR technologies.

- Triple helix model will be leveraged to provide advisory and consultation services on the application of the latest technologies.

- Analytical tools will be utilised to assist in providing predictive information for data-driven decision-making.

|

| Strategy A5: Enhancing Cooperation under IMT-GT and BIMP-EAGA |

Increasing Cross-Border Economic Activities and Strengthening Value Chains

- MSMEs will be encouraged to diversify and modernise cross-border economic activities as well as venture into downstream industries.

- Cross-border economic activities will be accelerated by adopting the digital platform, promoting private sector participation and developing talent through upskilling and reskilling.

- A strategic action plan will be formulated to accelerate cross border value chain development. In line with the project-centric approach of IMT-GT Vision 2036 and BIMP-EAGA Vision 2025, at least 30 catalytic projects with a strong focus on enhancinglocal economic activities will be identified. approach of IMT-GT Vision 2036 and BIMP-EAGA Vision 2025, at least 30 catalytic projects with a strong focus on enhancing local economic activities will be identified.

|

| Strategy C2: Diversifying and Boosting Economic Activities |

Re-energising Rural Cottage Industries

- Efforts will be intensified to re-energise the rural cottage industry through various initiatives in supporting MSMEs.

- Natural endowments and resources will be leveraged to create business and employment opportunities as well as generate additional income for the rural population.

- Private sector and social enterprises will be encouraged to participate in rural economic activities.

|

| CHAPTER 7: Enhancing Socioeconomic Development in Sabah and Sarawak |

| Strategy |

Measures |

Strategy B1: Reenergising Economic Activities

|

Promoting Digital Economy

- MSMEs will be encouraged to adopt digital technologies in production and business services.

- Training, mentoring and awareness programmes will be implemented for MSMEs in enhancing readiness to digitalise and compete in the local and global market.

- One-stop centres with connections to other parts of the country will be established to assist local MSMEs to have better access to funding, facilities and stewardship.

- eRezeki and eUsahawan programmes will be improved and expanded to increase the skills and opportunities of the rakyat in Sabah and Sarawak.

- National Digital Economy and 4IR Council will be leveraged in solving digitalisation issues in Sabah and Sarawak

Modernising Agriculture Sector

- Agricultural activities in Sabah will focus on producing high value agrofood, aquaculture, deep sea fishing and dairy produce.

- Ranau and Keningau will be further developed as the main producer of vegetables and dairy products, while Kota Belud has been identified to undertake large scale paddy and fruit farming.

- Dedicated food production areas such as the Taman Kekal Pengeluaran Makanan (TKPM) and Zon Industri Akuakultur (ZIA) will be upgraded to encourage modern agriculture.

- Deep sea fishing industry utilising high-tech fishing vessels will be further encouraged to leverage the availability of resources and competitive advantage.

- Integrated Agricultural Development Areas of Kalaka Saribas and Samarahan in Sarawak will be transformed into modern agriculture areas.

- Utilisation of digital technology will be enhanced through the application of smart farming and precision agriculture along the production value chain.

- Collaboration with HEIs in the area of research will also be intensified, focusing on soil testing, production of seeds and breeds, as well as biosecurity control.

Strengthening Oil and Gas Subsector

- The gas masterplans which was finalised by the state of Sabah & Sarawak in 2020 were designed to ensure long-term energy security for the development of the gas industry as well as provide strategies to attract new investment in gas-related industries.

Enhancing Resource-Based Manufacturing Activity

- Capabilities and competitiveness of MSMEs in resource-based manufacturing activity will be enhanced with greater adoption of automation and technology.

- Development of the aerospace industry in Sabah will focus on maintenance, repair and overhaul (MRO), as well as becoming centre of excellence for skilled training.

- Due to Sarawak’s frequent use of rural air transportation for the provision of basic social services i.e. mobile healthcare services and RAS, the focus for Sarawak will be on helicopter operations and MRO.

Enhancing the Services Sector

- Promotional campaigns will also be tailored to celebrate the unique qualities of Sabah and Sarawak.

- Business registration regulations will be reviewed and reformed to improve the ease of doing business.

- Businesses will be encouraged to leverage eCommerce platforms and modernise business processes through digitalisation.

Accelerating the Construction Sector

- Incentives will be introduced to encourage more industry players to adopt the latest construction technologies.

- Akademi Binaan Malaysia in Sabah and Sarawak will conduct reskilling, upskilling and accreditation programmes to produce qualified local talent.

|

Strategy B2: Strengthening the Development of Micro, Small and Medium Enterprises

|

Improving Access to Financing

- Special fund for Sabah & Sarawak will provide more opportunities for MSMEs to apply financial assistance to grow their business.

- Special programmes will be implemented to increase awareness of available financing for MSMEs.

- Mobile banking will be expanded to provide better access to financing.

Enhancing Resource-Based Micro, Small and Medium Enterprises Activities

- MSMEs in Sabah and Sarawak will be encouraged to utilise domestic natural resources in producing high value-added products and services.

- MSMEs participation in industries such as oil and gas, ecotourism, agri-business and palm oil will be further strengthened. The growth of these industries will increase the opportunities for capable MSMEs to participate in the supply chain for downstream activities.

- Comprehensive entrepreneurship training and development programmes will be developed to encourage MSMEs to venture into higher value-added services within the resource-based industries.

Facilitating Ease of Doing Business

- Existing network of business registration counters across Sabah and Sarawak will be expanded and innovative registration mechanisms will be introduced to facilitate business registration.

- Districts offices will be encouraged to act as the focal point to disseminate information on programmes offered by the Federal and state governments as well as FIs.

Boosting Micro, Small and Medium Enterprises Market Access

- Mechanism for aggregation of MSME products will be introduced to provide wider market access through utilisation of existing platforms at the district, municipal and local leader levels in small and mid- size towns.

- MSMEs will be encouraged to increase the sales of products and services through adoption of technology and digitalisation.

|

Strategy B4: Advancing Rural Development

|

Re-energising Rural Economic Activities

- Smart and cluster farming activities will be undertaken by utilising idle land to increase economies of scale, while village cooperatives will be strengthened.

- Community-based economic activities will continue to be implemented including Projek Bersepadu Pembangunan Ekonomi Kampung and Program Desa Lestari.

- Rural cottage industry will be enhanced through various initiatives in supporting MSMEs.

- Social enterprises and the private sector will also be encouraged to participate in diversifying rural economic activities.

- Incentives including the provision of agricultural inputs, such as seeds, breeds and fertilisers, as well as financial support will be provided to assist agropreneurs in venturing into agricultural activities.

- Capacity building programmes will be provided to improve technical capabilities whilst technical expert teams will be formed through public-private partnership to provide advisory services in increasing agricultural produce

Providing Access to Online Businesses

- Access to online business platforms will be capitalised to elevate competitiveness and capacity of rural entrepreneurs of Sabah and Sarawak.

- 133 Pusat Internet in Sabah and 138 in Sarawak, comprising of PKD, Pusat Internet Desa and Pusat Internet, will be optimised as platforms to promote digitalisation among rural entrepreneurs.

- DesaMall@KPLB programme will be expanded to assist rural entrepreneurs in migrating from traditional business methods to online businesses for better market access.

|

Strategy B6: Promoting Green Growth

|

Accelerating Green Initiatives

- Businesses will be encouraged to implement the circular economy along their value chain, particularly using recycled materials to produce green products.

- Economic instruments, environmentally motivated subsidies and the existing green financing incentives will be leveraged to support businesses in greening their activities.

|

Strategy C1: Improving Access to Education

|

Enhancing Industry Collaboration Network

- TVET institutions are encouraged to work closely with industry in extending industrial training or industry attachment period.

- Existing laboratories and workshops at the institutions will be upgraded as the Institution-Industry Lab (IIL) through shared ownership between selected TVET institutions and industries. The establishment of IIL will benefit both parties in terms of the transfer and sharing of knowledge, skills and technology.

|

Strategy D1: Addressing Poverty and Diversifying Sources of Income

|

Increasing and Diversifying Sources of Income

- Sources of income of the poor households will be increased and diversified through participation in high value-added economic activities as well as human capital and entrepreneurship development.

- Rich natural resources and culture will be leveraged to commercialise high value-added indigenous products, including arts and crafts as well as venturing into agriculture, aquaculture and ecotourism industries.

- Upskilling programmes, especially TVET, will be intensified.

- Untapped ancestral skills and talent of local communities will be unleashed by providing customised skills training.

- Entrepreneurship ecosystem such as financing assistance and marketing through digital platforms will be strengthened to facilitate entrepreneurs in accelerating the socioeconomic development.

|

Strategy D2: Strengthening Anak Negeri Sabah and Bumiputera Sarawak Socioeconomic Development

|

Improving Employability and Promoting Entrepreneurship

- Education and training will be pursued to enhance the capacity and capability, starting from early childhood care and education until tertiary level.

- These communities will also be encouraged to venture into ecotourism, agriculture and aquaculture as well as indigenous arts and crafts activities.

- Entrepreneurship will be inculcated among these communities by providing necessary support such as financing facilities, logistic services and access to market, including through digital platform.

- Access to the human resources development fund programmes will be improved to enhance the employability of youth by providing dedicated reskilling and upskilling programmes to leverage local economic opportunities.

- Youth will be provided courses on self-discipline, interpersonal and communication skills, adaptability and self-confidence to better compete with more experienced workers.

- Youth who are inclined towards entrepreneurship will be channelled to specific programmes in developing their ability to venture into business

|

| CHAPTER 8: Advancing Green Growth for Sustainability and Resilience |

| Strategy |

Measures |

Strategy A1: Moving Towards a Low-Carbon Nation

|

Expanding the Green Market and Government Green Procurement

- Increase demand for local green products, services and technologies as well as encourage the private sector to undertake green procurement. To enhance capability and prevent greenwashing, local industries, especially MSMEs, will be encouraged to participate in green industry development programmes, including capacity building, certification, dissemination of information and business matching.

- Initiatives to facilitate industries to obtain green labels will be enhanced by providing appropriate financial mechanisms and technical expertise.

|

Strategy A2: Accelerating Transition to the Circular

Economy

|

Creating an Enabling Ecosystem for the Circular Economy

Businesses, especially MSMEs, will be encouraged to adopt the circular economy concept in the design, production, logistics, consumption and waste management of products and services. |

Chapter 9: Enhancing Energy Sustainability and Transforming the Water Sector

|

| Strategy |

Measures |

Strategy A2: Ensuring Sustainable and Progressive Oil and Gas Subsector

|

Enhancing the Capability of Local Players in Oil and Gas Services and Equipment Subsector: Concerted efforts will be undertaken to enhance the capability of local OGSE SMEs through establishing consortia, increasing collaborations and promoting strategic partnerships.

|

Strategy A3: Enhancing the Electricity Subsector

|

Enhancing Energy Efficiency

- The use of energy by high-intensity consumers in the industrial and commercial sectors will be regulated through the formulation of an act related to energy efficiency and conservation.

- The Energy Audit Conditional Grants (EACG) will continue to be given to selected industrial and commercial sectors to enhance energy efficiency.

|

Strategy B4: Ensuring Sustainable Financing

|

Promoting Innovative Financing

- The private sector will also be encouraged to invest in water sector transformation projects such as wastewater resource recovery, R&D&C&I and smart technology applications.

- The existing Green Technology Financing Scheme will also be leveraged to inculcate water saving habit and promote circular economy practices among water-intensive industries.

|

| CHAPTER 10: Developing Future Talent |

| Strategy |

Measures |

Strategy A1: Promoting Equitable Compensation of Employees and Labour Participation

|

Strengthening Labour Market

- Guidelines will be developed to facilitate employers to reorganise their work systems to improve compensation of employees. The guidelines will be disseminated to firms especially MSMEs.

- Firms will also be encouraged to adopt new models for better distribution of profits. Such models include the employee ownership trust (EOT), whereby the holdings of the firms are placed under a trust controlled by employees.

- A model to mandate profit sharing of firms based on a minimum number of employees will be introduced. These new models of ownership will ensure profits are broadly shared, while the workers are given a stake in the firms.

- Efforts to increase membership in trade union will be intensified to enable stronger bargaining power in wage negotiations. Co-determination approach will be introduced to allow worker representatives at the decision-making level. These measures will facilitate better involvement and engagement of employees with employers in determining the compensation structure of firms.

Facilitating Labour Force Participation

- Review the multi-tier levy mechanism every two years to reduce the dependency on foreign workers and promote greater local participation in the labour market.

- A specific policy will also be introduced to reduce dependency on foreign workers to ensure that they leave the country after a certain period. Employers will adhere to this policy through an undertaking as a prerequisite for permit approval.

- Employers hiring expatriates will also be subjected to the specific policy. In this regard, the salary scale of expatriates in all categories will be revised upwards to ensure that only jobs with skillsets that are not available locally are offered to expatriates.

- The excess levy collected through the implementation of multi-tier levy mechanism will be channelled to industry for the purpose of increasing job opportunities and implementing upskilling and reskilling programmes for locals. Among the initiatives that can be funded include industry automation and mechanisation. The fund will also be used to incentivise employers to create a more conducive working environment to attract locals.

- The current insurance guarantee mechanism will be replaced with a new mechanism, which requires deposit equivalent to total deportation cost, to prevent foreign workers from overstaying. This effort will be implemented together with the Holistic Enforcement Plan for Illegal Immigrants, the Foreign Workers Action Plan and the Recalibration Plan for Illegal Immigrants.

- Females with secondary educational attainment will be encouraged to participate in labour market through home-based economic activities while continuing with household responsibilities. In addition, a new law will be introduced to mandate employers to provide childcare facilities, of which penalties will be imposed for those who failed to comply.

- The Returning Expert Programme (REP) will be enhanced to make it compulsory for all Malaysians who are working, are going to and are coming back to report to the government. A comprehensive database for the Malaysian diaspora will be established to better utilise available talent for the national interest.

|

Strategy A2: Strengthening the Labour Market Support System

|

Promoting Responsive Workforce Training

- The Human Resource Development Corporation levy reimbursement mechanism will be revised to support more training for low- and semi-skilled workers who are susceptible to be displaced with the emergence of 4IR technologies.

- An extensive review of the current standard classification of occupations to incorporate information on skills requirement will be undertaken to establish a comprehensive and dynamic national skills framework.

Addressing Labour Displacement due to COVID-19 Pandemic

- Initiatives by various stakeholders will be coordinated by the newly established National Employment Council (NEC) chaired by the Prime Minister.

- The employment services portal will be enhanced to enable redistribution of the workforce disrupted by the COVID-19 pandemic besides redeployment of displaced workers due to automation.

- Efforts to move industry to higher value-added activities through automation will be continued. The related incentives will be reviewed to incorporate components in facilitating necessary training for employees to effectively work with new automation technologies.

Providing Decent Work for Gig Workers

- A social protection scheme, which includes unemployment and health benefits, as well as retirement savings, will be enhanced.

- A training fund for gig workers will be established to assist in upgrading their skills in order to move to a more favourable employment.

Encouraging Shared Responsibility

- An existing facility will be upgraded as a dedicated training hub for learning, knowledge sharing, and capacity building for the employers, employees and enforcement officers.

- - The Hub will also provide certification to employees from the private sector as human resource practitioners in undertaking firm level assessment on compliance with the labour laws and regulations.

|

Strategy B1: Raising the Quality of Education

|

Enhancing TVET Programme

Industry within the proximity of TVET institutions will be leveraged to provide students with better exposure to the latest technology as well as gain industrial experience. These initiatives will align skills produced to the needs of industry. |

Strategy B3: Leveraging Emerging Technology

|

Strengthening TVET through Digital Learning

Collaboration between TVET institutions and industry will be intensified to provide more opportunities for instructors and students to apply latest technologies as well as experience actual industry operations and challenges. |

Strategy B5: Addressing Overlap in TVET Governance

|

Enhancing Quality Programmes

Upskilling and reskilling programmes will be expanded to include micro credentials, industrial attachments, training and cross fertilisation. |

| CHAPTER 11: Boosting Digitalisation and Advanced Technology |

| Strategy |

Measures |

Strategy A1: Providing an Enabling Environment for the Growth of the Digital Economy

|

Local MSMEs will be encouraged to increase eCommerce trading through integration of existing one-stop centres to enable better access to funding, facilities and stewardship. The centre will also coordinate intervention related to digital businesses and cross border trading to encourage local businesses in penetrating the global market.

Malaysia Cyber Security Strategy (MCSS) will be implemented to spearhead efforts to manage cyber threats. The cyber security legal framework will be strengthened and the Cyber Security Act will be enacted. MSMEs will be encouraged to adopt cyber security measures and a secure digital environment in line with increasing digital adoption to grow businesses. |

Strategy A4: Positioning Malaysia as the ASEAN

Digital Centre

|

Digitalising Micro, Small and Medium Enterprises to Broaden Market Access

- MSMEs will be encouraged to adopt digital technologies in production, processes and business services, mainly in the back-end of business operations.

- - Training and awareness programmes will be implemented for MSMEs to enhance readiness to digitalise and compete in the international market. Appropriate digital solutions will be identified and proposed to match the level of business readiness through digital adoption incentives.

- - A holistic financing mechanism will be provided to accelerate the adoption of digital solutions by MSMEs. The eBerkat initiative will be further promoted to assist MSMEs as well as entrepreneurs among the B40 in acquiring knowledge, securing insurance and accessing micro-financing services. MSMEs and entrepreneurs digitalisation needs and peer-to-peer financing will be identified. This will enable the MSMEs to participate in bigger markets and expand their businesses internationally.

|

Strategy B1: Expanding Digitalisation

|

Facilitating Digital Opportunities

- One-stop service centres will be established to guide and facilitate the on-boarding of MSMEs to venture into business and go global. In addition, a comprehensive database will be developed to enhance the planning and monitoring of the MSMEs development.

Creating More Online Business Ventures

- The coverage and effectiveness of eRezeki and eUsahawan programmes will be improved to increase the digital skills and opportunities for the targeted groups, including those involved in the sharing economy.

|

Strategy C1: Strengthening Capacity and Capability in Research, Development, Commercialisation and Innovation

|

Strengthening Funding for Research, Development, Commercialisation and Innovation (R&D&C&I)

- EPU will ensure at least 50% of total R&D expenditure under RMKe-12 is for experimental development research with high commercialisation potential. Measures will be undertaken to increase access to alternative financing including through venture capital and international funding.

- - Endowment fund will be established to source funds from industry, matching grants, crowdfunding and waqf, for STI-related R&D activities, which expected to increase the percentage of GERD to GDP to 2.5% by 2025.

|

Strategy D1: Gearing up for the Fourth Industrial Revolution

|

Seizing Economic Growth Opportunities Arising from the Fourth Industrial Revolution

- Efforts will be intensified to establish a conducive ecosystem, including by enhancing the capabilities of MSMEs and improving coordination in implementing existing programmes and initiatives. Ten potential sectors will be focused for applications of the Fourth Industrial Revolution technologies.

i. Wholesale and retail trade

ii. Transportation and logistics

iii. Tourism

iv. Manufacturing

v. Agriculture

vi. Professional, scientific and technical services

vii. Healthcare

viii. Education

ix. Finance and insurance; and

x. Utilities.

- 4IR innovation parks will be established to provide a secure testbed and pool together with 4IR technology providers to stimulate new technology breakthroughs. The parks, supported by 5G-enabled key services, among others cloud computing and supercomputers, will provide access for MSMEs and innovators to develop products and solutions utilising emerging technologies such as AI, IoT and big data analytics.

Creating a Conducive Ecosystem to Harness the Potential of the Fourth Industrial Revolution

- The regulatory sandbox will be further expanded beyond fintech to other technologies in various sectors, which will allow start-up companies and innovators to test solutions under a controlled and supervised regulatory environment.

- A performance-linked incentives related to 4IR technology adoption will be expanded to non-manufacturing sectors to reap the benefits of 4IR.

- A dedicated tech fund will be established to encourage companies, especially MSMEs to adopt 4IR technology. A portion of funds will be sourced from the additional levy collected from the implementation of the multi-tiered levy on foreign workers.

- Training for 4IR-related skills will also be provided by various skills training institutions in collaboration with industry players to meet industry demand.

|

CHAPTER 12: Enhancing Efficiency of Transport and Logistics infrastructure

|

Strategy

|

Measures

|

Strategy B1: Enhancing Efficiency of Services

|

Adopting Multimodal Cargo Movement

- Logistics industry will be encouraged to adopt multimodal cargo movement approach to enhance logistics services capability and reduce the cost of distribution.

- A multimodal cargo movement uses multiple modes of transport with one transport bill of lading and a single transport service provider. Single service providers will be responsible for moving the shipment in all routes and modes. This will expand access to remote areas and real-time shipment tracking, resulting in improved service availability, reliability and efficiency.

Improving Last-Mile Connectivity to Main Ports

- The rail networks within main ports and access roads to main ports will be upgraded. Cargo hubs at strategic locations adjacent to the ports will be identified to provide integrated logistics facilities.

|

Strategy B2: Leveraging Digitalisation in Services

|

Operationalising a Single-Window Transaction Platform

- uCustoms, a single-window transaction platform, will be fully operationalised to further improve the ease of doing business by providing a web based, electronic end-to-end solution. The platform will enable permit issuing agencies to use uniformed operating procedures. It will also enable cost savings and remote working.

|

Strategy C2: Promoting Green initiatives

|

Mandating Adoption of Environmental Standards

- Mandatory adoption of environmental standards such as the National Green Standards for transport operators will be imposed to expedite the implementation of green practices in the transport and logistics sectors. Incentives will be provided to encourage the adoption of these standards.

- The Green Transport Index will also be introduced to promote clean and sustainable transport systems as well as resilient infrastructure for efficient mobility.

Implementing the Low Carbon Mobility Blueprint

- In the land transport sector, the use of low carbon alternatives such as energy-efficient vehicles, hybrid and electric vehicles will be promoted.

Enhancing Communication, Education & Public Awareness (CEPA)

- CEPA programmes will be intensified, targeting transport operators, manufacturers, service providers and users of transport and logistics services. Therefore, collaboration among stakeholders will be strengthened in implementing CEPA to induce green behaviour among users.

|

Source: Economic Planning Unit Details are available at https://rmke12.epu.gov.my