Business Accelerator Programme for Indian-Owned Companies (I-BAP) is an integrated assistance programme aimed to enhance the capabilities of small-sized companies through business advisory services and financial support. This programme supports a wide range of capability-building initiatives to assist MSMEs grow and expand their business locally and globally.

Type of Assistance

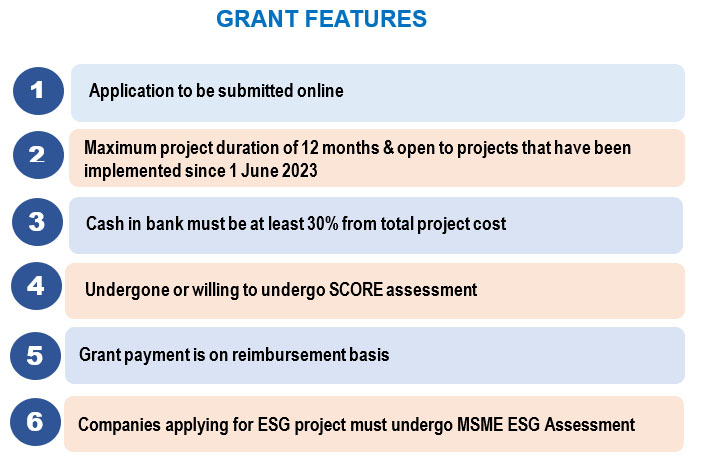

- Matching grant 50% of the eligible expenses (maximum RM100,000)

Eligibility Criteria

- Having a valid MSME Status Certificate

- At least 60% of local Indian ownership

- Having a valid Business Premise License from Local Authorities

- At least 12 months in operations from the date of application

- Major / common shareholders in 2 or more Private Limited Companies are only eligible to submit 1 application

- Enterprise owned by the same owner in 2 or more enterprises (sole proprietorship or partnership) are only eligible to submit one application

- Companies or enterprises that have received the BAP 3.0 grants (2021, 2022 & 2024) and I-BAP 2024 are not eligible to apply

- The same project that has been approved under any programme by SME Corp. Malaysia is not eligible

- Open to all economic sectors EXCEPT sectors related to primary agriculture, financial, insurance, real estate, and securities trading sectors (priority will be given to the high growth industries)

Priority Criteria

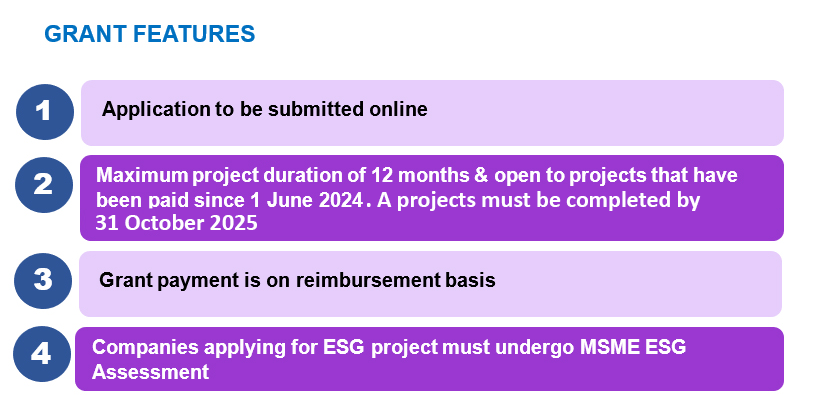

- Priority is given to projects that have been completed and have made payments to suppliers (payment made from 1st June 2024).

Project Scope

- Acquisition of Machineries & Equipment (Productivity & Automation)

- ICT Adoption & E-Commerce

- ESG (Environment, Social & Governance) Adoption

- Product Certification

- Advertising & Promotion (limited to RM50,000 only)

Basic Application Documents

- Superform document from SSM

- Business Premise License from Local Authorities

- Audited Financial Statement for the last 3 years or the latest management accounts

- Bank statements for the last 3 months

- 2 quotations from preferred and comparison supplier

Application

Application is closed

For more information, please contactt:

Info Line: 03-9213 0077

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

SME Corporation Malaysia

Aras 4, Blok B, Platinum Sentral

Jalan Stesen Sentral 2

Kuala Lumpur Sentral

50470 Kuala Lumpur

DISCLAIMER

All commitments and assistance provided under this Programme are subject to fund availability. SME Corp. Malaysia reserves the right to terminate or suspend the Programme, or change the content or format of the Programme, at any time without notice to any party, and may demand an immediate cessation of any specific use of this Programme. SME Corp. Malaysia has the right to suspend, terminate, or block public access to this Programme at any time. SME Corp. Malaysia will not be responsible for any loss or damage sustained by any party participating in this Programme.

Please note that SME Corp. Malaysia has never appointed consultants / third parties to fill in and submit applications under this Programme. If it is found that a company is using consultants / third parties, SME Corp. Malaysia has the right to automatically cancel / withdraw the company's application.

WARNING

Providing false or misleading information for the purpose of deceiving SME Corp. Malaysia is a criminal offense under the Penal Code, with penalties including imprisonment and caning, as well as the possibility of fines. Additionally, SME Corp. Malaysia reserves the right to deny any benefits, or assistance if false information is associated with an application.

SME Corp. Malaysia also wishes to highlight the provision under Section 17A of the Malaysian Anti-Corruption Commission Act 2009, which establishes the principle of corporate liability, whereby a commercial organisation commits an offense if any of its employees and/or associates engage in corruption for the organisation's benefit. The commercial organisation can be deemed liable regardless of whether its senior management or representatives are aware of the corrupt conduct committed by the employees or associates.